Overview

There has been a lot of noise recently about terms like "bitcoin," "blockchain," and "cryptocurrency." Some of it is hype, but some of it points to important forces in the financial services industry. So what does it all mean?

We can help. We’ve pulled together a few short articles that explain why a lot of industry observers are paying close attention.

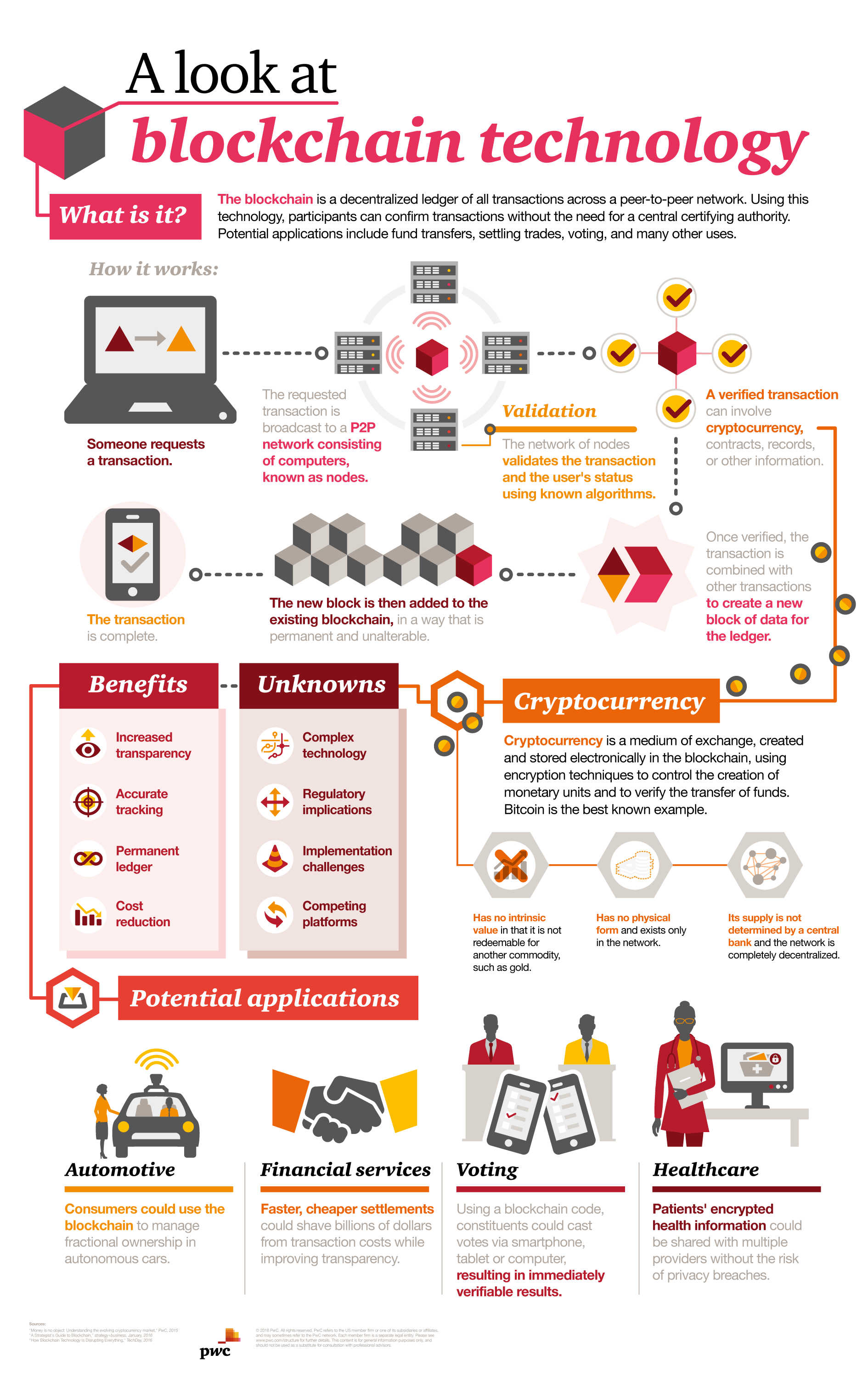

Let's start with some quick definitions. Blockchain is the technology that enables the existence of cryptocurrency (among other things). Bitcoin is the name of the best-known cryptocurrency, the one for which blockchain technology was invented. A cryptocurrency is a medium of exchange, such as the US dollar, but is digital and uses encryption techniques to control the creation of monetary units and to verify the transfer of funds.

Blockchain also has potential applications far beyond bitcoin and cryptocurrency. Blockchain is, quite simply, a digital, decentralized ledger that keeps a record of all transactions that take place across a peer-to-peer network. The major innovation is that the technology allows market participants to transfer assets across the Internet without the need for a centralized third party.

From a business perspective, it’s helpful to think of blockchain technology as a type of next-generation business process improvement software. Collaborative technology, such as blockchain, promises the ability to improve the business processes that occur between companies, radically lowering the “cost of trust.” For this reason, it may offer significantly higher returns for each investment dollar spent than most traditional internal investments.

Financial institutions are exploring how they could also use blockchain technology to upend everything from clearing and settlement to insurance.

For an overview of cryptocurrency, start with “Money is no object.” This paper, from PwC’s Financial Services Institute, focuses on cryptocurrency. We explain where it came from, how much consumers know about it and use it, what it will take for the market to grow, and what the regulators think. We also look at how market participants, such as investors, technology providers, and financial institutions, will be affected.

For some quick background on blockchain, take a look at these two short articles.

- The first Q&A provides some examples of the innovative uses of blockchain implemented by financial institutions and an overview of the challenges and opportunities that blockchain presents for the industry.

- The second Q&A discusses the trends that have shaped blockchain technology and how it has been used and developed.

For a deeper dive into blockchain’s implications, read “A strategist’s guide to blockchain.” This article, from strategy+business, examines the potential benefits of this important innovation — and also suggests a way forward for financial institutions. Put simply, proceed deliberately. Explore how others might try to disrupt your business with blockchain technology, and how your company could use it to leap ahead instead. In all cases, link your investments to your value proposition, and give your business partners and your customers what they want most: speed, convenience, and control over their transactions.

For a peek into the application of blockchains for smart contracts, check out “Blockchain and smart contract automation”. This short series of articles explore how blockchains, both public and private, have triggered a global hunt for ways to remove friction from transaction-related processes, including the process of reaching contractual agreements. Learn about the precursors, challenges, and future outlook of implementing smart contracts. We also chat with Gideon Greenspan of Coin Sciences to learn about his views on the legal ramifications of public blockchains and why companies are seeking alternatives.

When a technology moves so quickly, it’s dangerous to sit on the sidelines. We’re watching blockchain move from a startup idea to an established technology in a tiny fraction of the time it took for the Internet or even the PC to be accepted as a standard tool. Blockchain technology could result in a radically different competitive future for the financial services industry. These articles will help you understand these changes — and what you should do about them.

How PwC can help

Any blockchain solution, no matter how prescient, is only as good as its execution. This is where PwC excels—by offering proven expertise in managing complex implementation programs from start to finish.

What PwC delivers:

- Business and functional requirements

- Design, development, testing and training of blockchain solutions

- Integration and management of third party implementation partners

- Rigorous PMO and proactive management of overall efforts

Original article and pictures take www.pwc.com site